Financial Advisors Illinois Can Be Fun For Everyone

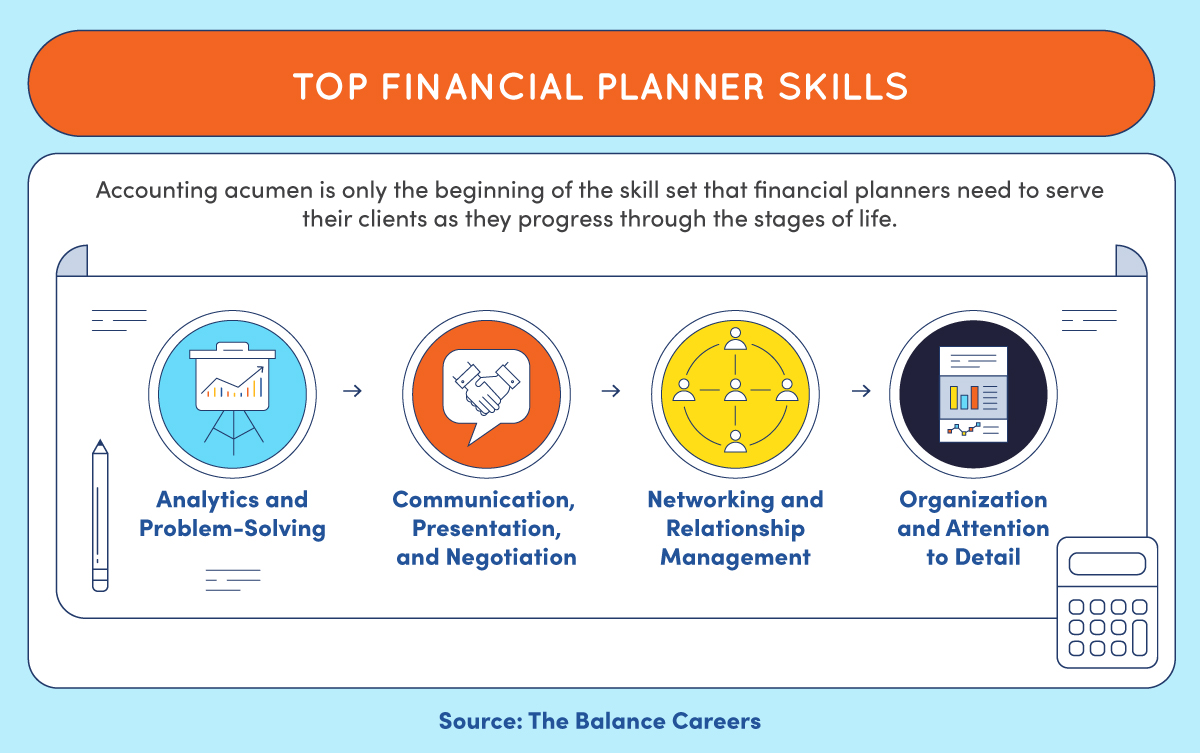

A monetary consultant may hold different qualifications, which can attest to their understanding, skills and experience. A Licensed Monetary Coordinator (CFP), as an example, can supply broad monetary preparation suggestions. An authorized financial investment consultant (RIA), on the other hand, is mostly worried about supplying suggestions about investments. Financial experts can work for big wealth management firms, insurer or broker agents.

In exchange for their services, financial advisors are paid a cost, commonly around 1% of assets managed each year. Some advisors are fee-only, implying they just bill costs for the solutions they offer. Others are fee-based, suggesting they gather costs based upon the products or services they recommend. Either kind of economic advisor may be a fiduciary, indicating that they're obliged to act in the most effective interests of their customers in all times.

Financial Advisors Illinois Can Be Fun For Everyone

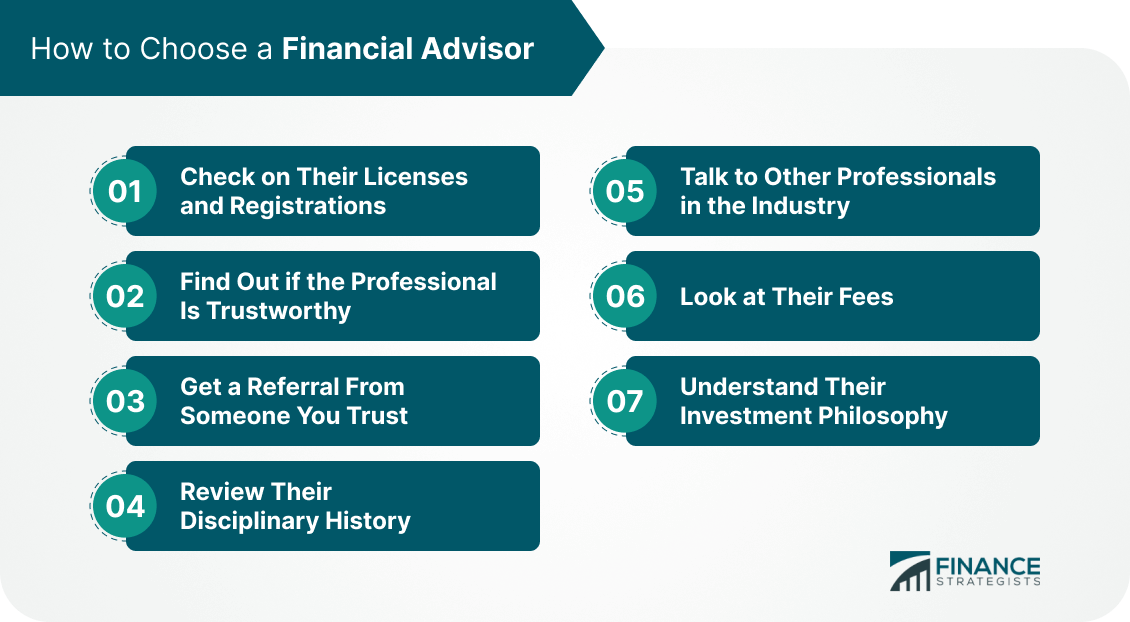

There are some hints that can make it simpler to separate the good from the negative. Below are nine traits to consider in your search for a monetary consultant: If you're dealing with an economic consultant, it's most likely due to the fact that you're relying upon their knowledge to help you produce a workable plan for managing your cash.

If you're asking standard questions regarding charges, communication design or an advisor's record and are consulted with dirty answersor none at allthat's a sign that you might want to look somewhere else for advice. An excellent financial expert focuses on communication with their clients. When vetting experts, it's valuable to ask exactly how often you can expect them to get in touch, what their chosen techniques of interaction are and that you can go to with questions if they're inaccessible.

Financial Advisors Illinois for Dummies

It's also crucial for an advisor's personality to fit together well with your own. If you're an autist, for instance, you might locate dealing with an exceptionally extroverted expert hard.

An easy method to assess a consultant's credibility is to ask. Great monetary consultants understand that it's people, not revenues, that issue most.

Preparing a clear collection of questions before you sit down with a consultant can make the procedure easier and aid you identify red flags. Asking about background and experience is an excellent place to start. Figure out how long they have actually operated in the market, what designations they hold and what kind of clients they usually offer.

Financial Advisors Illinois Things To Know Before You Buy

Fees are an additional vital factor to raise. Ask whether the consultant is fee-only or fee-based and exactly how their compensation is structured. Some consultants charge a flat charge, others expense on a per hour basis and several charge a percent of properties under management. Make certain you comprehend precisely just how they make money and what solutions are covered under their charge.

What makes an excellent economic expert? It isn't just one point; rather, there are countless characteristics that an excellent monetary expert can have.

If you're satisfying with an economic consultant for the very first time, it helps to have a go-to list of questions prepared. For instance, you can ask them regarding their background and credentials, their charge structure, their investment design and the kind of customers they commonly work with. Finding an economic consultant additionally doesn't require to be hard.

Take a look at the experts' profiles, have an initial get in touch with the phone or intro personally, and pick that to function with. Locate Your Advisor Financial experts help their clients produce a prepare for reaching their economic objectives. Details tasks supplementary information that experts can aid with include budgeting, financial obligation payment, retired life planning and university cost savings.

Get This Report about Financial Advisors Illinois

In exchange for their solutions, financial experts are paid a fee, typically around 1% of possessions took care of each year. Some advisors are fee-only, suggesting they only bill costs for the services they offer. Others are fee-based, implying they collect costs based upon the items or solutions they advise. Either kind of financial advisor might be a fiduciary, implying that they're obligated to act in the ideal interests of their customers in all times.

There are some ideas that can make it simpler to separate the excellent from the bad. Here are 9 traits to take into consideration in your search for a monetary advisor: If you're functioning with an economic advisor, it's likely because you're relying upon their competence to aid you create a practical plan for handling your money.

If you're asking standard questions regarding fees, communication style or a consultant's track record and are satisfied with dirty answersor none at allthat's an indicator that you might desire to look elsewhere for suggestions. An excellent financial consultant focuses on interaction with their customers. If you're unsure whether or not a consultant is a fiduciary, you can ask them straight and after that confirm their standing via BrokerCheck.

Top Guidelines Of Financial Advisors Illinois

A basic method to gauge an expert's credibility is to ask. If you have good friends or family members who function with a consultant, ask what they like or don't like about them. Reviewing online evaluations is another way to see what people need to say concerning an advisor. Great financial experts recognize that it's people, not profits, that matter most.

Preparing a clear collection of concerns before you take a seat with a consultant can make the process much easier and assist you identify warnings. Inquiring about background and experience is a good location to begin. Discover the length of time they have operated in the market, what designations they hold and what kind of clients they usually serve.

The Best Strategy To Use For Financial Advisors Illinois

Having that commitment in creating offers you added security as a customer. Validating their answer with your very own research utilizing devices like FINRA BrokerCheck can verify that the advisor is both certified and trustworthy. What makes a great monetary consultant? It isn't just something; rather, there are various attributes that a good economic advisor can possess.

In exchange for their solutions, financial advisors are paid a charge, typically around 1% of assets took care of per year. Either type of monetary consultant might be a fiduciary, implying that they're obliged to act in the ideal passions of their clients at all times.

There are some hints that can make it much easier to separate the great from the bad. Right here are nine traits to consider in your look for a monetary advisor: If you're dealing with a monetary consultant, it's likely due to the fact that you're counting on their expertise to assist you create a practical prepare for handling your cash.

Get This Report on Financial Advisors Illinois

If you're asking fundamental questions concerning fees, communication style or an advisor's record and are consulted with murky answersor none at allthat's a sign that you might intend to look in other places for guidance. A good economic advisor prioritizes communication with their clients. When vetting consultants, it's useful to ask how usually you can anticipate them to contact us, what their favored approaches of interaction are and who you can go to with questions if they're not available.

It's also essential for an advisor's individuality to mesh well with yours. If you're an introvert, for example, you may find managing an incredibly extroverted advisor hard. Extroverts, on the other hand, may find an introverted advisor also scheduled for their tastes. The finest financial experts allow their reputation do the talking for them.

Examine This Report on Financial Advisors Illinois

An easy way to assess an advisor's online reputation is to ask. Excellent economic experts recognize that it's individuals, not earnings, that issue most.

Preparing a clear set of inquiries before you sit down with a consultant can make the process easier and aid you spot red flags. Asking concerning background and experience is an excellent place to start. Learn for how long they have functioned in the sector, what classifications they hold and what sort of clients they typically serve.

Some consultants charge a level fee, others expense on a hourly basis and many charge a percentage of properties under administration. Make sure you recognize exactly just how they obtain paid and what solutions are covered under their charge.

Having that commitment in composing provides you included defense as a client - Financial Advisors Illinois. Confirming their response with your own study utilizing devices like FINRA BrokerCheck can confirm that the consultant is both qualified and trustworthy. What makes a great monetary advisor? It isn't just one point; rather, there are various characteristics that a good monetary advisor can possess.